Glass production heating, glass price increase

fanyu

chinamirrormanufacturer.com

2018-03-06 14:20:06

Affected by the expected impact of real estate policies this week, the market is also expected to cool down during the peak season. The actual situation, gradually clear after the Lantern Festival, the demand for good factors is limited to the winter part of the demand delay in the spring and real estate investment is still resilient. The negative factor is that the repressive effect of the supply-side reform on the funding side and investment demand since the previous year has gradually become apparent. In the short term, the risk is higher than previously expected. The real demand there is no risk of sharp fluctuations in the seasonal peak season is still more obvious this week, a number of ultra-white glass substantial price increases, Taishan fiberglass price.

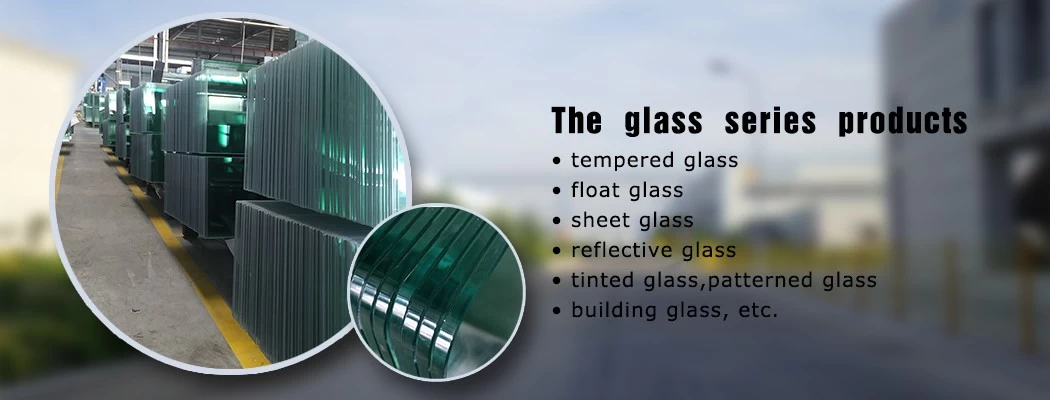

Tarzan glass fiber products this week, price increases 200 yuan / ton, usher in a new round of price hikes. As the cost performance of glass fiber increases, the downstream applications continue to expand, cyclical weakening of the industry, highlighting the growth, while the price of steel and other competitive products is conducive to enhancing permeability of glass fiber. In our opinion, the industry is affected by the tight supply and demand pattern. The long-term price is still expected to rise. The leading enterprises continue to grow in volume and price. The company is located in: The company is located in:glassLarge-scale production line shut down in January 2016 will be on March 15 ignition, although the continuous resumption of production has not yet filled the gap caused by the Shahe focus on production but the weak supply side of the glass industry, part of the zombie production capacity of the re-production Need to be alert. The company is located in: In the medium term, the performance matching of cyclical leaders is still good, with high growth and historically low valuations generally seen in 2018 (see table below). The logic of demand-stabilization and supply-side reform by 2020 remains king, with the logic of supply-side logic in place, leading global demand. Future market share will be more focused on leading enterprises, only the leader can gain growth. Conch has surpassed other cement stocks over the past two years. Conch has not only increased domestic market share, but also new foreign capacity is accelerating. Conch's outstanding strategic and tactical capabilities combined with the current round of global infrastructure investment demand provide an incremental cement market and a company's overseas capacity or accelerated release. Other traditional cyclical industries such as glass are similar deductions. The company is located in: Segments with growth attributes have received more attention before, the valuation is generally in the upper limit of the historical range. In the medium term, continued performance of the business can still bring significant benefits. Short-term preference in the market style also has the impulse. |